bartoarley

Browsing the Tornado: Strategies for Monetary Durability in Times of Financial Unpredictability -

Financial unpredictability, whether arising from a worldwide pandemic, a recession, or various other unexpected occasions, can be a difficult time for people and companies alike. Yet, it's throughout such rough times that monetary durability becomes critical. Here are some strategies that will help you browse the tornado and ensure your monetary security.

1. Expand Your Earnings

Reliance on a solitary resource of earnings can be risky, especially throughout uncertain times. Diversifying your earnings means having actually several earnings streams. This could involve handling independent work, purchasing possessions that produce easy earnings, or beginning a side business. The aim is to produce a monetary buffer should one earnings stream fail.

2. Produce an Emergency situation Money

An emergency situation money is a monetary safeguard designed to cover unexpected costs or to sustain living costs throughout durations of earnings loss. A great guideline is to contend the very least 3 to 6 months' well worth of living costs set apart in a quickly accessible savings account Read More.

3. Stay Informed

Maintaining abreast of monetary information and trends will help you make informed choices about managing your money. This consists of understanding how the economic climate is doing, what's happening in the job market, and any federal government measures that might impact your monetary circumstance.

4. Review and Change Your Budget

A well-planned budget can be an effective device throughout times of financial unpredictability. Your earnings or costs may change, so it is necessary to review your budget regularly and change as necessary. If your earnings has reduced, determine non-essential costs that you could decrease or eliminate. If your earnings has enhanced, assign the additional money towards savings or financial obligation repayment.

5. Pay Down High-Interest Financial obligation

High-interest financial obligation, such as credit card financial obligation, can quickly build up and become a monetary concern. Preferably, aim to settle high-interest financial obligations. Decreasing these financial obligations can maximize more of your earnings for savings or various other costs.

6. Proceed to Spend, But Be Careful

According site http://ideas.66ghz.com. Financial downturns can present buying opportunities for financiers. However, it is important to walk carefully. Expand your profile, understand your risk resistance, and maintain a long-lasting point of view. If you are uncertain, consult from a monetary consultant.

7. Concentrate on Professional Development

Upskilling or reskilling can be a great way to improve your job security and possibly open new earnings opportunities. Consider online courses, accreditations, or further education and learning in your area or a location of rate of passion.

8. Have a Back-up Plan

Having actually a strategy B can provide assurance and a way ahead if your monetary circumstance changes significantly. This could involve plans to decrease spending, potential job opportunities if you shed your present job, or alternative living arrangements if you cannot maintain your present lifestyle.

Browsing through financial unpredictability can be challenging, but by being positive, informed, and versatile, you can weather the tornado. Monetary durability isn't about fast fixes; rather, it has to do with tactical, long-lasting planning that enables you to satisfy your monetary responsibilities and maintain monetary security also in the face ofin the face of financial adversity.

- 2023

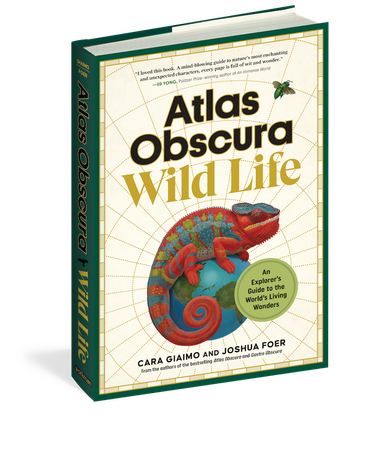

joined atlas

obscura

0

countries

I've visited

0

I've visited

places

I've been

0

I've been

places

I want to go

0

I want to go

places

added

0

added

places

published

0

published

places

edited

edited