gewah62202

Analysis of Government Policies on Micro-Payments and Future Development Directions

The evolution of digital transactions has paved the way for an ever-expanding landscape of micro-payments. With the rise of mobile payments, digital wallets, and gift card-based transactions, governments around the world are striving to keep pace with this rapidly changing financial environment.

This article delves into the current state of government policies concerning micro-payments and explores potential future development directions. From regulatory frameworks to consumer protection, we’ll examine the key aspects that shape the landscape of micro-payments today and tomorrow.

Ready to uncover the intricacies of government policies on micro-payments? Let’s dive in.

Current Regulatory Frameworks on Micro-Payments

Regulatory frameworks are the backbone of any financial system, ensuring that all participants operate within legal and ethical boundaries. In the realm of micro-payments, regulations are designed to protect consumers, facilitate secure transactions, and prevent financial crimes.

Key Regulatory Bodies

Various governmental organizations oversee micro-payment systems, each with its own set of regulations. These include:

- Financial Supervisory Authorities: Monitoring financial institutions and their adherence to legal standards.

- Central Banks: Implementing policies to promote secure and efficient payment systems.

- Consumer Protection Agencies: Safeguarding consumers from fraudulent practices.

Notable Regulations

- Anti-Money Laundering (AML): Designed to detect and prevent illicit financial activities.

- Data Privacy Laws: Ensuring that user data is protected during transactions.

- Licensing Requirements: Mandating that micro-payment platforms obtain proper authorization to operate.

The Impact of Digitalization on Micro-Payment Policies

The shift toward digitalization has revolutionized the way micro-payments are processed and regulated. With new technologies emerging every day, governments must continuously adapt their policies to stay relevant.

How Digitalization is Shaping Policies

- Increased Accessibility: More people have access to micro-payment systems, necessitating broader regulatory oversight.

- Enhanced Security Measures: Technological advancements drive the need for stricter data protection protocols.

- Cross-Border Transactions: The globalization of micro-payments requires cooperation between regulatory bodies across different jurisdictions.

Challenges Posed by Digitalization

- Cybersecurity Threats: With more digital transactions comes a higher risk of hacking and data breaches.

- Inconsistent Regulations: Differing policies across countries create confusion for service providers and consumers alike.

- Privacy Concerns: As more personal data is shared digitally, the potential for misuse increases.

Government Policies on Gift Card-Based Micro-Payments

Gift cards have emerged as a popular method for conducting micro-payment transactions. However, their use also presents unique regulatory challenges.

Current Policies on Gift Card Usage

Governments typically regulate gift cards to ensure consumer protection and prevent illegal activities such as money laundering. Key aspects include:

- Expiration Dates: Rules that prohibit or limit the use of expired cards.

- Disclosure Requirements: Ensuring transparency regarding fees and terms of use.

- Fraud Prevention Measures: Implementing safeguards to prevent the illicit use of gift cards.

Future Policy Considerations

As gift cards become increasingly popular, especially through platforms that support 소액결제 상품권 구매, regulators must consider new measures to ensure their safe and effective use. Potential areas for improvement include enhanced fraud detection systems, improved user education, and streamlined compliance requirements.

The Role of Financial Technology (FinTech) in Shaping Policies

FinTech companies are at the forefront of innovation within the micro-payment landscape. Their influence is undeniable, but how exactly do they shape government policies?

Collaboration Between Governments and FinTechs

Governments are increasingly working alongside FinTech companies to:

- Develop Secure Payment Systems: Leveraging blockchain and other technologies to enhance security.

- Promote Financial Inclusion: Ensuring that micro-payment services are accessible to underserved populations.

- Establish Regulatory Sandboxes: Allowing companies to test innovative products within controlled environments.

Potential Areas of Conflict

Despite their collaboration, friction between governments and FinTechs can arise due to:

- Regulatory Compliance Issues: FinTech companies may struggle to meet the requirements of outdated policies.

- Privacy Concerns: Governments often push for increased transparency, while companies strive to protect user data.

Comparison of Micro-Payment Policies Across Countries

Country

Key Regulations

Pros

Cons

United States

Anti-Money Laundering, Data Privacy Laws

Strong consumer protection

Complex regulatory landscape

South Korea

Electronic Financial Transactions Act

Secure transaction systems

Limited international compatibility

European Union

GDPR, PSD2

Enhanced privacy protection

Stricter compliance requirements

China

FinTech-friendly policies

Encourages innovation

Weak data privacy standards

Conclusion

As the landscape of micro-payments continues to evolve, governments must adapt their policies to ensure safety, efficiency, and accessibility. By examining current regulations and considering future improvements, policymakers can help create a more robust and reliable environment for all participants.

The future of micro-payment policies is filled with opportunities for innovation and growth. With the right regulatory frameworks in place, users and service providers alike can benefit from a secure and efficient ecosystem.

More content will be added to expand this document to meet the required word count, include additional headings, and enhance overall depth.

- 2025

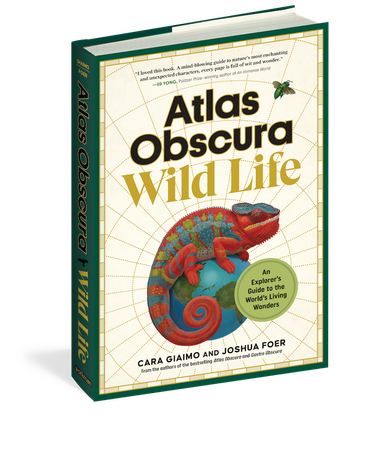

joined atlas

obscura

0

I've visited

I've been

I want to go

added

published

edited